VAT laws were implemented with effect from 1st January 2018 in the UAE. As easy as the implementation of the VAT looks, it still needs to be attended to with accuracy. Our objective is to take the stress and hassle out of completing your quarterly VAT returns.

It is our goal to provide valuable advice in all areas of taxation in the country and if needed in other countries as well. Whether you’re a an individual or a business owner for large enterprise, we aim to help you make truly informed decision about your tax positioning as required by the laws of the United Arab Emirates.

We will handle your taxation services thoroughly and account them accurately in your books for timely filing as per the UAE legislations. Please feel free to call or whatsapp us anytime.

Let your Tax journey starts with us

Our perfect assistance will make this path smooth for you.

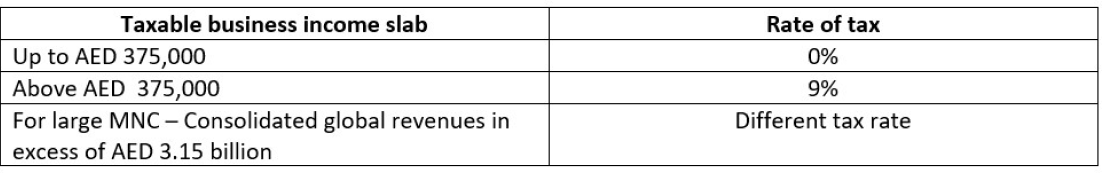

The Corporate Rate Taxes

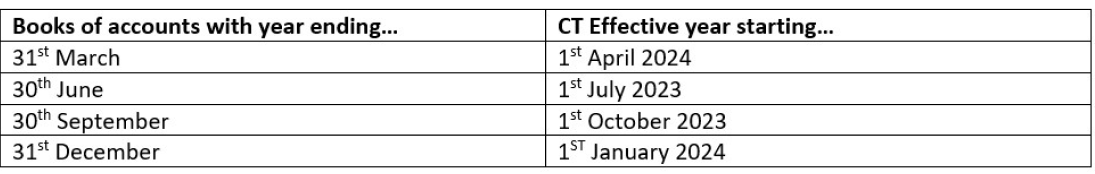

Announcement date: Jan 31, 2022

Effective date: For Financial Years starting on or after Jun 1, 2023

Implications

Experience Precision, Performance, and Perfect Balance with Our Services

Our perfect assistance will make this path smooth for you.

Carry Forward & Setoff Losses

Accumulated taxable losses (from CT effective date) will be allowed to offset future taxable income. Tax losses from one group company may be used to offset taxable income of another group company, subject to certain conditions.

Taxable Income

On adjusted accounting net profit

Tax Group

Tax grouping and group relief provisions are allowed. A UAE group of companies can chose to form a tax group and can file consolidated tax returns subject to certain conditions.

Withholding Tax

No withholding tax will apply on domestic and cross border payments

Taxable Categories

All businesses having trade license Individuals earning business income under a commercial license

Exempt

Dividend and capital gains earned by a UAE business from its qualifying shareholdings. Qualifying intra group transactions and re organizations will not be subject to UAE CT, provided subject to certain conditions.

No Corporate Tax On Income Earned By Individual In Personal Capacity

Salary or other employment earnings Rental Income from real estate Investment income : Interest on bank deposit or saving instruments / capital gain, dividend on shares etc. Income earned by foreign investors who do not conduct business in the UAE.

UAE Free Zone Business

FZB are required to register and file CT return. Existing tax incentives to continue for FZB that comply with all regulatory requirements and do not conduct business with mainland UAE.

FAQs

- Compliance support in all areas of taxation

- Specialist tax advisors

- Structuring your business affairs in a tax efficient manners

As per UAE VAT Law, any business above mandatory limit is required to comply and follow the articles of the Executive Regulations issued by Federal Tax Authority.

- VAT Consultancy for Compliance & Support

- VAT Registration & De-registration Formalities

- VAT Return Submission

- VAT Risk Assessment

- VAT Audit compliance

- VAT Accounting Review

- Corporate Taxation

- NRI Taxation